On January 25th, 2023 the White House released a Fact Sheet laying out their action plan to increase fairness in the housing industry. This is in conjunction with the new Blueprint for a Renters Bill of Rights.

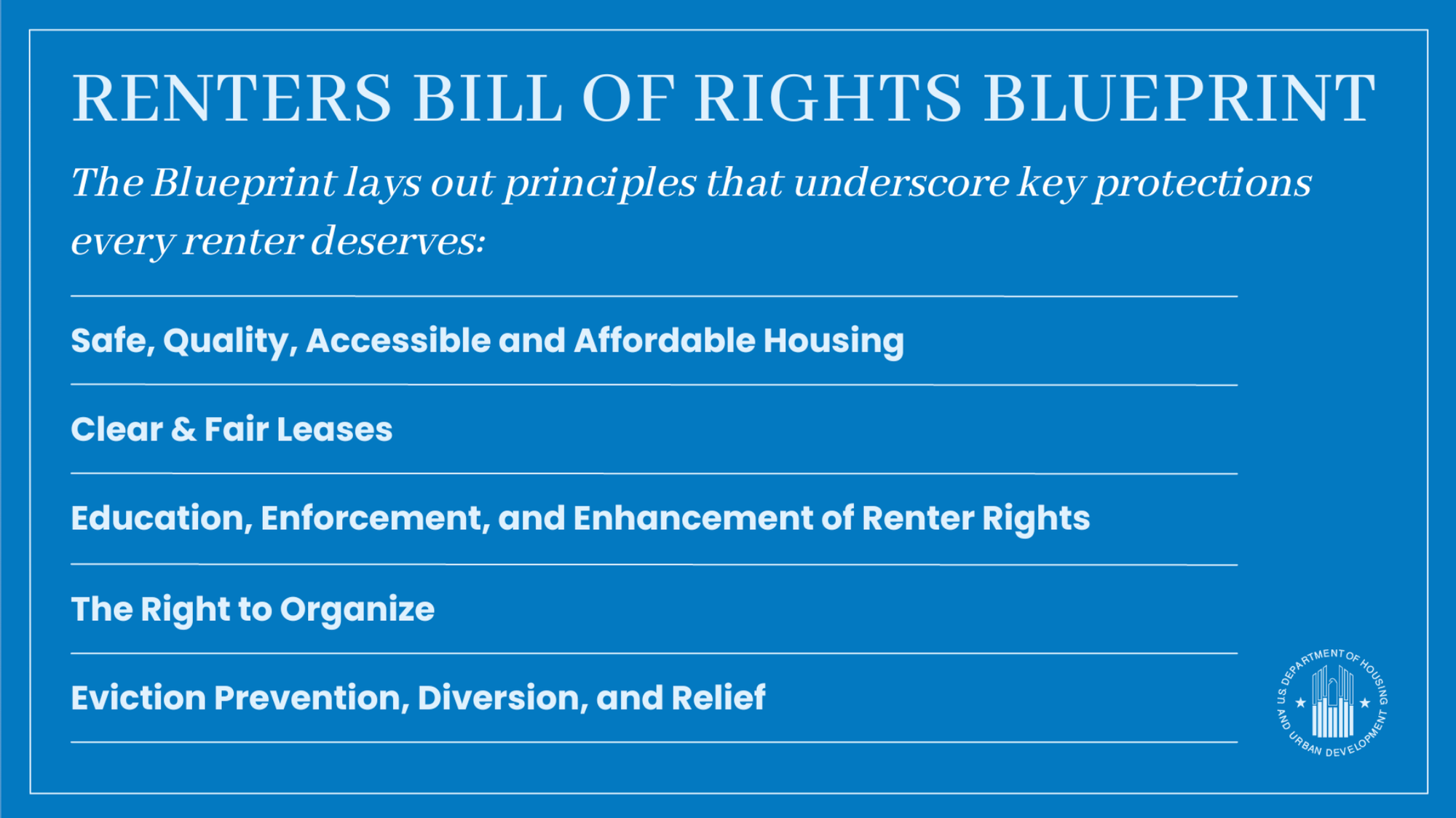

The Blueprint for a Renters Bill of Rights is attempting to create protections they feel every renter deserves, including:

- Safe, Quality, Accessible, and Affordable Housing

- Clear and Fair Leases

- Education, Enforcement, and Enhancement of Renter Rights

- The Right to Organize

- Eviction Prevention, Diversion, and Relief

Whether you agree with the Biden-Harris administration or not, it's important to understand the highlights of these newly introduced ideas and enforcements within our industry. I encourage you to read The Blueprint for a Renters Bill of Rights and familiarize yourself with the changes, especially if you manage properties that participate in public housing or Housing Choice (Section 8) programs.

Here are the highlights from the Biden-Harris announcement and their plan to promote rental affordability:

- Freddie Mac creating survey of each state's landlord-tenant laws. Intention to create consolidated source of information on current state landlord-tenant laws for public and industry stakeholders.

- The Federal Trade Commission (FTC) will explore ways to expand its authority under the FTC Act and investigate fair housing practices, specifically exploring unfair practices in the rental market. For example, background checks, algorithms of tenant screening, adverse action notices, and source of income.

- Accountability for credit reporting systems

- Public process to examine limits on egregious rent increases

- US Department of Justice workshop with law, tech, and other subject matter experts to explore the effects of modern technology for information sharing and whether guidance updates are necessary in anticompetitive information sharing rules.

- The Federal Housing Finance Agency (FHFA) will classify multifamily loans which restrict rental rates to an affordable rate, 80 and 120% of area median income, as \"mission-driven\". In 2023, at least 50% of Freddie Mac and Fannie Mae purchases of multifamily loans must be mission-driven.

- The Department of Defence (DoD) will ensure military members have housing assistance regardless of if they are on or off base. This may include housing inspection, rent negotiations, lease review, etc.

- HUD is looking into ways to improve Section 504, ensuraing those with disabilites have equal access and opportunity in housing and additional programs.

- Requirement to require at least 30 days' advanced notice prior to lease termination due to nonpayment of rent in public housing.

- Quarterly meetings with groups of tenants to ensure they have a seat at the table.

- USDA 2023 pilot program to institue a uniform inspection protocol using trained inspectors across it's housing portfolio.

- In 2024, HUD to launch the National Standards for the Physical Inspection of Real Estate. This will align multiple HUD programs to the same standards.

- USDA will institute actions to advance clear leases and compliance for it's portfolio. This will be similar to the HUD Section 8 agreement and policies.

- The CFPB will identify rules to ensure the background screening industry adheres to the law. It will also work with law enforcement to enforce those laws.

- HUD, FHFA, FTC, and USDA will work with CFPB on best practices on the use of tenant screening reports and background checks.

- The Treasury Department will look for ways to future the goals of tenant protections, including those around Source of Income.

- HUD exploring guidance and opportunities to address Source of Income.

- Fannie May launched Expanded Housing Choice pilot program to incentivize property owners who agree not to discriminate against voucher holders.

- Actions regarding the right to organize - DoD will ensure military members can organize, HUD's Office of Multifamily Housing to distribute appropriated funds for tenant education and outreach, implementation of RAD (Rental Assistance Demonstration).

- HUD to award $20 million to the Eviction Protection Grant Program.

- FHFA, Freddie Mac, and Fannie Mae to publish Enterprise Look Up Tools to allow tenants to see if their property requires 30 day notice to vacate for nonpayment.

Let us know in the comments or on our social media pages how you think these changes and updates will impact the industry. Are these positive changes or not? You decide.